Running a business in India means one thing is non-negotiable: GST-compliant invoicing. Whether you are a freelancer, shop owner, manufacturer, wholesaler, or service provider, issuing a GST invoice with HSN code is essential for smooth taxation, legal compliance, and hassle-free input tax credit (ITC).

In this detailed guide, we’ll explain everything in simple, human-friendly language what a GST invoice maker is, why HSN codes matter, how to create invoices correctly, common mistakes to avoid, and how an online GST invoice maker with HSN code can save you time and money.

Table of Contents

ToggleWhat Is a GST Invoice Maker?

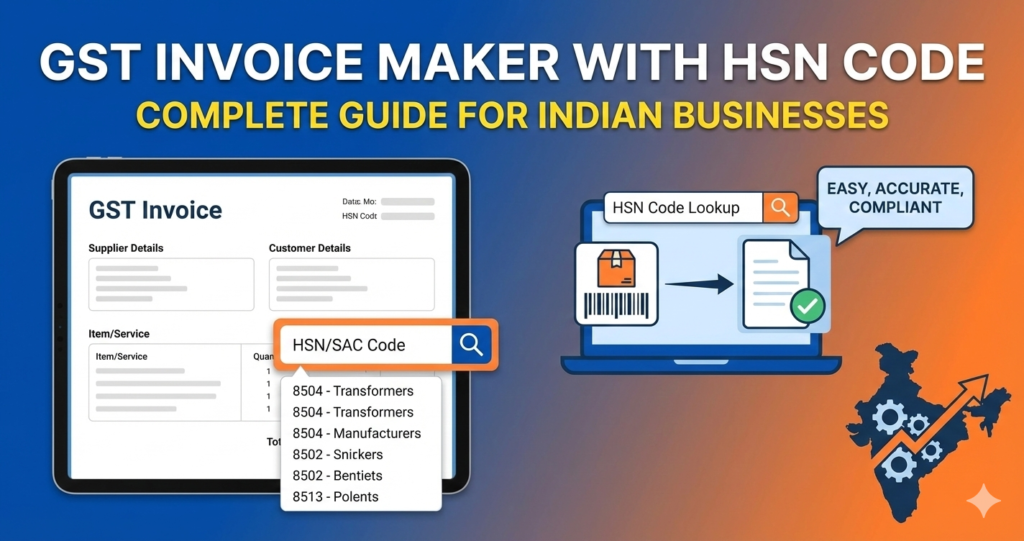

A GST Invoice Maker is an online or offline tool that helps businesses generate GST-compliant invoices without manual calculations or formatting errors.

Instead of creating invoices in Excel or Word (which often leads to mistakes), a GST invoice maker:

- Automatically calculates CGST, SGST, or IGST

- Allows adding HSN or SAC codes

- Follows the latest GST invoice format

- Generates professional invoices instantly

- Helps maintain proper records for audits and returns

When combined with HSN code support, the invoice maker ensures your tax classification is accurate and legally valid.

What Is an HSN Code in GST?

HSN (Harmonized System of Nomenclature) is a standardized system used to classify goods under GST. Each product is assigned a numeric code that determines the applicable GST rate.

Why HSN Code Is Important

- Mandatory under GST law

- Helps determine the correct tax rate

- Required for GST returns (GSTR-1, GSTR-3B)

- Avoids disputes with tax authorities

- Ensures buyers can claim Input Tax Credit (ITC)

HSN vs SAC Code

| Type | Used For | Example |

|---|---|---|

| HSN | Goods | Mobile phones, clothing, machinery |

| SAC | Services | IT services, consultancy, repair |

Is HSN Code Mandatory on GST Invoices?

Yes, HSN code is mandatory, but the number of digits depends on your annual turnover.

HSN Code Requirement (Latest Rule)

| Annual Turnover | HSN Digits Required |

|---|---|

| Up to ₹5 crore | 4 digits |

| Above ₹5 crore | 6 digits |

| Export / Import | 8 digits |

If you are issuing GST invoices without the required HSN digits, your invoice may be considered non-compliant.

What Should a GST Invoice with HSN Code Contain?

A valid GST invoice must include the following details:

Mandatory Invoice Fields

- Supplier name, address & GSTIN

- Invoice number (unique & sequential)

- Invoice date

- Buyer name, address & GSTIN (if registered)

- HSN code or SAC code

- Description of goods or services

- Quantity & unit

- Taxable value

- GST rate (CGST/SGST or IGST)

- Tax amount

- Total invoice value

- Place of supply

- Signature or digital signature

A GST invoice maker with HSN code auto-adds most of these fields, reducing human error.

Why Use an Online GST Invoice Maker with HSN Code?

Many businesses still rely on Excel or handwritten bills. This may work initially, but as transactions grow, problems start appearing.

Key Benefits

1. Error-Free Tax Calculation

No manual calculation mistakes. GST is calculated automatically based on HSN code.

2. Faster Invoicing

Create invoices in less than a minute—ideal for daily billing.

3. Professional Appearance

Clean, branded invoices improve customer trust.

4. GST Compliance

Always follows the latest GST rules and formats.

5. Easy Record Management

Invoices are stored digitally and easily downloadable.

6. Ideal for Small Businesses & Startups

No accounting knowledge required.

How a GST Invoice Maker with HSN Code Works (Step-by-Step)

Here’s how most online invoice makers function:

Step 1: Enter Business Details

Add your business name, address, GSTIN, and logo.

Step 2: Add Customer Information

Include buyer name, address, and GSTIN (if applicable).

Step 3: Add Product or Service

- Product name

- Quantity

- Price

- HSN or SAC code

Step 4: Select GST Type

- Intra-state → CGST + SGST

- Inter-state → IGST

Step 5: Auto-Calculation

The tool calculates tax based on HSN code and GST rate.

Step 6: Generate & Download Invoice

Download as PDF or share directly with customers.

Who Should Use a GST Invoice Maker with HSN Code?

This tool is useful for:

- Small business owners

- Freelancers & consultants

- Retail shop owners

- Wholesalers & distributors

- Manufacturers

- E-commerce sellers

- Service providers

Even CA firms and accountants use invoice makers to speed up client work.

Common Mistakes to Avoid in GST Invoicing

Even small errors can lead to penalties or ITC rejection.

Avoid These Mistakes

- Using wrong HSN code

- Missing HSN digits as per turnover

- Incorrect GST rate

- Duplicate invoice numbers

- Wrong place of supply

- Manual rounding errors

A GST invoice maker minimizes all these risks.

GST Invoice Maker with HSN Code for Small Businesses

If you run a small business, this tool is especially helpful because:

- No accounting software required

- No GST expert needed

- Works on mobile & desktop

- Saves money on bookkeeping

- Keeps you GST-return ready

Many small businesses face GST notices simply due to invoice formatting issues, not tax evasion. Automation solves this problem.

Is a Free GST Invoice Maker Safe to Use?

Yes, as long as:

- It follows the latest GST rules

- Allows HSN/SAC code entry

- Generates non-editable PDF invoices

- Stores data securely

Avoid tools that do not allow HSN code input or export invoices without tax breakup.

GST Invoice Maker with HSN Code for Future Growth

As your business grows, invoice volume increases. A proper invoice maker helps with:

- Monthly GST filing

- Year-end audits

- Business analysis

- Cash-flow tracking

- Professional brand image

In short, it becomes a core business tool, not just an invoice generator.

Frequently Asked Questions (FAQ)

What is a GST invoice maker with HSN code?

It is a tool that creates GST-compliant invoices and includes mandatory HSN or SAC codes for tax classification.

Is HSN code compulsory for GST invoice?

Yes, HSN code is mandatory as per GST law, based on turnover limits.

Can I generate GST invoice without GSTIN?

Only if you are an unregistered seller issuing a bill of supply, not a GST tax invoice.

Can I edit a GST invoice after generating it?

Once issued, GST invoices should not be edited. Any correction must be done using a credit note or debit note.

Do freelancers need HSN code?

Freelancers providing services must use SAC codes, not HSN codes.

Can GST invoice makers be used on mobile?

Yes, most modern GST invoice makers work on both mobile and desktop.

Is digital signature mandatory on GST invoice?

Digital signature is recommended but not mandatory for all businesses.

A GST Invoice Maker with HSN Code is no longer optional—it’s a necessity for Indian businesses. It ensures compliance, accuracy, professionalism, and peace of mind. Whether you issue 5 invoices a month or 500, automation saves time and protects you from costly GST mistakes.

If you want stress-free GST billing, using a proper invoice maker with HSN code support is one of the smartest business decisions you can make in 2026.