Running a business in India means dealing with GST compliance, and one of the most important parts of that compliance is issuing a proper GST invoice. Whether you’re a freelancer, small business owner, startup founder, or growing enterprise, manually creating invoices can quickly become confusing, time-consuming, and error-prone.

That’s exactly where a GST invoice generator comes in.

A GST invoice generator helps you create professional, accurate, and government-compliant invoices within minutes without worrying about complex tax calculations or formatting rules. In this guide, we’ll explore what a GST invoice generator is, why it’s essential, what features you should look for, and how to use one effectively.

Table of Contents

ToggleWhat Is a GST Invoice Generator?

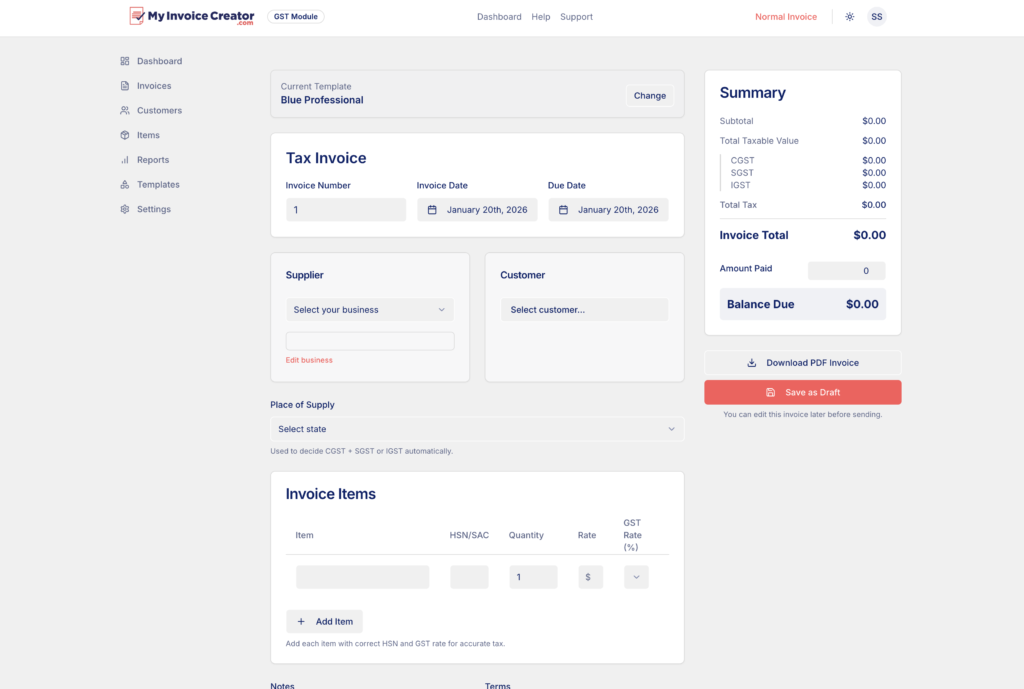

A GST invoice generator is an online tool or software that allows businesses to create GST-compliant invoices by automatically calculating taxes like CGST, SGST, or IGST, applying correct invoice formats, and including all mandatory details required under Indian GST law.

Instead of designing invoices manually in Word or Excel, a GST invoice generator ensures that:

- Your invoices meet legal requirements

- Tax calculations are accurate

- Records are organized and professional

Modern tools like MyInvoiceCreator make this entire process fast and beginner-friendly.

Try a simple and free GST invoice generator here: https://myinvoicecreator.com/

Why Using a GST Invoice Generator Is Important

1. Saves Time and Effort

Manual invoicing takes time—especially when tax rates, formats, and calculations are involved. A GST invoice generator automates everything so you can focus on growing your business.

2. Reduces Errors

GST errors can lead to penalties or return mismatches. Automated invoice tools reduce calculation mistakes and formatting issues.

3. Ensures Legal Compliance

GST rules specify what must be included in an invoice—GSTIN, HSN/SAC codes, tax breakup, invoice number, place of supply, and more. A good GST invoice generator ensures nothing is missed.

4. Professional Appearance

Professionally designed invoices build trust with clients and improve your brand image.

5. Easy Record-Keeping

Most online invoice generators store your invoices digitally, making accounting, audits, and GST return filing easier.

Who Should Use a GST Invoice Generator?

A GST invoice generator is ideal for:

- Freelancers & consultants

- Small and medium businesses

- Startups

- Online sellers

- Service providers

- Manufacturers & traders

Whether you issue one invoice a month or hundreds, automation always helps.

Key Features to Look for in a GST Invoice Generator

Not all invoice tools are created equal. Here are the features you should always check:

✔ GST-Compliant Format

The tool should automatically follow the latest GST invoice format as per Indian regulations.

✔ Auto Tax Calculation

CGST, SGST, IGST calculations should be handled automatically based on location.

✔ Custom Branding

Add your logo, business name, address, and contact details.

✔ Multiple Invoice Types

Support for:

- Tax Invoice

- Bill of Supply

- Proforma Invoice

- Credit Note & Debit Note

✔ Download & Share Options

Invoices should be downloadable in PDF and easy to share via email or WhatsApp.

✔ Cloud Access

Access invoices anytime, anywhere without worrying about losing data.

Platforms like MyInvoiceCreator include these essentials while remaining easy to use.

How a GST Invoice Generator Works (Simple Explanation)

Using a GST invoice generator is straightforward:

- Enter your business details (name, address, GSTIN)

- Add customer details

- Add product or service details

- Select applicable GST rates

- The tool calculates tax automatically

- Generate, download, and share the invoice

No accounting background needed.

Benefits of Using MyInvoiceCreator for GST Invoices

MyInvoiceCreator is designed specifically for Indian businesses that want simplicity without compromising compliance.

Here’s why many users prefer it:

- Clean and simple interface

- No complicated setup

- Works for freelancers and companies

- GST-ready invoice formats

- Accessible from any device

- Ideal for daily invoicing needs

👉 Start creating invoices instantly: https://myinvoicecreator.com/

Common GST Invoice Mistakes (And How a Generator Prevents Them)

Many businesses unknowingly make mistakes such as:

- Missing GSTIN

- Incorrect tax breakup

- Wrong invoice numbering

- Incorrect place of supply

- Manual calculation errors

A GST invoice generator eliminates these problems by following predefined rules and formats.

GST Invoice Rules You Must Know

Under Indian GST law, a valid GST invoice must include:

- Supplier name, address, and GSTIN

- Invoice number and date

- Recipient details and GSTIN (if registered)

- HSN or SAC code

- Description of goods/services

- Quantity and value

- Taxable value

- CGST/SGST/IGST breakup

- Place of supply

- Signature or digital authentication

You can always verify the latest rules from the official GST portal:

🔗 https://www.gst.gov.in/

GST Invoice Generator vs Manual Invoicing

| Feature | Manual Invoice | GST Invoice Generator |

|---|---|---|

| Time required | High | Low |

| Error chances | High | Very low |

| GST compliance | Risky | Guaranteed |

| Professional look | Depends | Always |

| Scalability | Poor | Excellent |

Clearly, using a GST invoice generator is the smarter option.

Is a Free GST Invoice Generator Enough?

For most freelancers and small businesses, a free GST invoice generator is more than sufficient. It covers:

- Basic invoice creation

- GST calculations

- PDF downloads

As your business grows, you can move to advanced features—but starting free is completely fine.

Frequently Asked Questions (FAQ)

What is the best GST invoice generator in India?

A good GST invoice generator should be simple, GST-compliant, and reliable. Tools like MyInvoiceCreator are widely used for ease and accuracy.

Can I generate GST invoices online for free?

Yes, many platforms offer free GST invoice generation with essential features.

Is GST invoice mandatory for all businesses?

If your business is registered under GST, issuing a GST invoice is mandatory for taxable supplies.

Can freelancers use GST invoice generators?

Absolutely. Freelancers registered under GST can easily generate invoices for clients.

Is it safe to use online invoice generators?

Yes, as long as you use a reputable platform with secure access and data protection.

Final Thoughts

A GST invoice generator is no longer a luxury—it’s a necessity for modern Indian businesses. It saves time, reduces errors, ensures legal compliance, and helps you look professional in front of clients.

If you want a simple, fast, and reliable solution, start with MyInvoiceCreator and experience stress-free GST invoicing.

👉 Create your GST invoice now: https://myinvoicecreator.com/