In day-to-day business, not every sale happens on credit. Many transactions are completed instantly—money paid, goods delivered, deal closed. For such situations, a cash invoice plays a crucial role. Whether you’re a small shop owner, freelancer, wholesaler, or service provider, understanding cash invoices helps you stay compliant, organized, and professional.

In this detailed guide, we’ll explain what a cash invoice is, how it works, when to use it, how it differs from other invoices, and how you can generate one easily using online tools.

Table of Contents

ToggleWhat Is a Cash Invoice?

A cash invoice is a commercial document issued by a seller when payment is received immediately at the time of sale. Unlike credit invoices—where payment is collected later—a cash invoice confirms that the buyer has already paid in full.

In simple words:

Cash Invoice = Payment Received + Proof of Sale

It acts as:

- A receipt for the buyer

- A sales record for the seller

- A supporting document for accounting and tax purposes

When Is a Cash Invoice Used?

Cash invoices are commonly used in situations where:

- Payment is made in cash

- Payment is completed via UPI, card, or wallet instantly

- No credit period is involved

- The seller does not allow delayed payments

Common use cases include:

- Retail shops

- Restaurants and cafés

- Freelancers offering one-time services

- Small manufacturers selling directly

- Local wholesalers and traders

Is a Cash Invoice Legal and Valid?

Yes, a cash invoice is completely legal and valid as long as it includes all required details such as:

- Seller information

- Buyer details (if applicable)

- Invoice number

- Date

- Item description

- Taxes (if applicable)

- Total amount paid

For GST-registered businesses in India, a cash invoice must also comply with GST invoice rules.

Cash Invoice vs Tax Invoice vs Credit Invoice

Many people confuse cash invoices with other invoice types. Let’s clear that up:

Cash Invoice

- Payment received immediately

- No outstanding balance

- Issued at the time of sale

Tax Invoice

- Issued mainly by GST-registered sellers

- Can be cash or credit based

- Shows GST breakup clearly

Credit Invoice

- Payment is collected later

- Includes due date

- Used for B2B or trusted clients

👉 A cash invoice can also be a tax invoice if GST is included.

What Details Should a Cash Invoice Include?

A professional cash invoice should include the following:

- Invoice Title – Clearly marked as “Cash Invoice”

- Invoice Number – Unique and sequential

- Invoice Date

- Seller Details – Name, address, phone, GSTIN (if any)

- Buyer Details – Name and address (optional for retail sales)

- Item Description – Products or services sold

- Quantity & Rate

- Subtotal

- Tax Details – GST, VAT, or applicable tax

- Total Amount Paid

- Payment Mode – Cash, UPI, Card, etc.

- Signature or Seal (optional but professional)

Cash Invoice Format (Simple Example)

Here’s a basic structure:

- Header: CASH INVOICE

- Seller Information

- Buyer Information

- Table with item details

- Tax summary

- Total paid amount

- Payment mode confirmation

Using a proper format improves trust and makes audits easier.

Benefits of Using Cash Invoices

1. Immediate Cash Flow

You receive payment instantly—no follow-ups, no delays.

2. Simple Accounting

No need to track receivables or due dates.

3. Lower Risk

Zero risk of non-payment.

4. Better Customer Trust

Customers appreciate instant receipts and transparency.

5. Easy Tax Calculation

Since payment is complete, tax reporting becomes straightforward.

Cash Invoice for Small Businesses and Freelancers

If you’re running a small business or working as a freelancer, cash invoices are ideal when:

- You offer one-time services

- You work with new clients

- You want immediate payment

For example:

- Graphic designers

- Consultants

- Repair services

- Tutors

- Event service providers

Cash Invoice Under GST (India)

If you are GST-registered:

- You must issue a GST-compliant cash invoice

- GST must be charged and shown separately

- HSN/SAC codes should be included

- Invoice should be uploaded in GST returns

If you’re not registered under GST, you can still issue a normal cash invoice without GST.

For official GST invoice guidelines, you can refer to the GST portal:

👉 https://www.gst.gov.in/

(External reference included as requested)

Can a Cash Invoice Be Cancelled?

Yes, but with conditions:

- If cancelled, it must be recorded properly

- A cancelled invoice should not be reused

- For GST invoices, cancellation must be reflected in returns

Never delete invoices from records—always mark them as cancelled.

Digital vs Manual Cash Invoices

Manual Cash Invoices

- Written or printed books

- Error-prone

- Hard to manage long-term

Digital Cash Invoices

- Auto calculations

- Professional design

- Easy sharing (PDF, WhatsApp, Email)

- Secure records

Modern businesses prefer digital invoices for speed and accuracy.

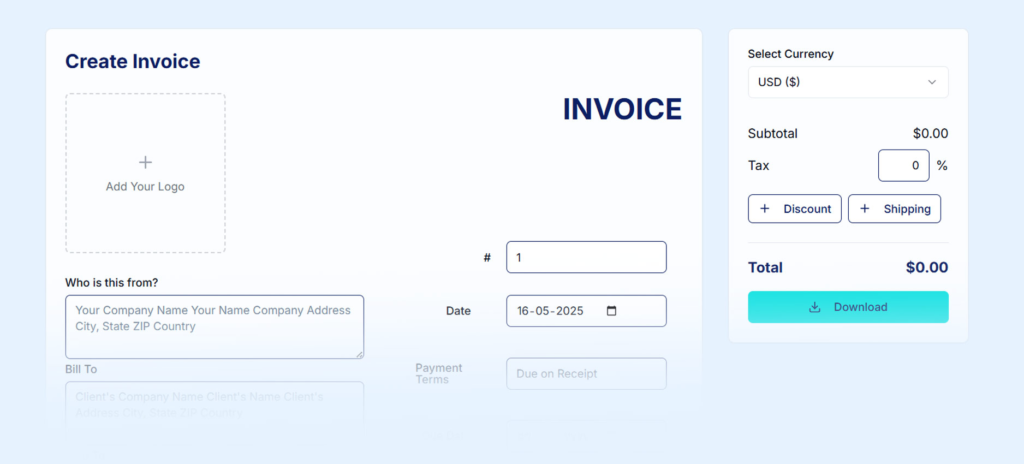

How to Create a Cash Invoice Online (Easy Method)

You don’t need accounting software or Excel skills anymore. You can generate a professional cash invoice online in minutes.

One such simple tool is My Invoice Creator, which allows you to:

- Create invoices instantly

- Customize fields

- Add tax details

- Download or share invoices

You can try it here:

👉 https://myinvoicecreator.com/

This is especially helpful for freelancers, startups, and small businesses who want quick and clean invoicing without complications.

Common Mistakes to Avoid in Cash Invoices

- Missing invoice numbers

- Not mentioning payment mode

- Incorrect tax calculation

- No seller details

- Using the same invoice number twice

Avoiding these mistakes keeps your records clean and compliant.

Are Cash Invoices Required for Every Sale?

While not mandatory for very small cash sales in some cases, issuing a cash invoice is always recommended. It:

- Protects both buyer and seller

- Acts as legal proof

- Helps during audits or disputes

FAQs About Cash Invoice

1. What is a cash invoice in simple terms?

A cash invoice is issued when the buyer pays immediately at the time of purchase.

2. Is a cash invoice the same as a receipt?

It works like a receipt but includes more detailed business and tax information.

3. Can a cash invoice include GST?

Yes, if the seller is GST-registered, GST must be included.

4. Is buyer name mandatory on a cash invoice?

Not always. For retail sales, it can be optional.

5. Can freelancers issue cash invoices?

Yes, freelancers can legally issue cash invoices for services.

6. Can I generate cash invoices online?

Yes, online tools make it quick and professional.

7. Is a cash invoice valid for accounting?

Absolutely. It’s a valid accounting document.

8. What payment modes qualify for a cash invoice?

Cash, UPI, debit card, credit card, or instant transfers.

9. Can a cash invoice be edited later?

Once issued, it should not be edited—only cancelled and reissued.

10. Do I need a signature on a cash invoice?

It’s optional but adds authenticity.